The Of Eb5 Investment Immigration

Table of ContentsThe 2-Minute Rule for Eb5 Investment ImmigrationWhat Does Eb5 Investment Immigration Do?How Eb5 Investment Immigration can Save You Time, Stress, and Money.See This Report about Eb5 Investment ImmigrationExcitement About Eb5 Investment Immigration

While we strive to supply precise and updated web content, it needs to not be taken into consideration legal suggestions. Immigration regulations and laws are subject to transform, and individual scenarios can vary widely. For personalized support and lawful advice concerning your particular migration situation, we highly advise speaking with a qualified migration lawyer who can offer you with customized assistance and guarantee compliance with current regulations and laws.

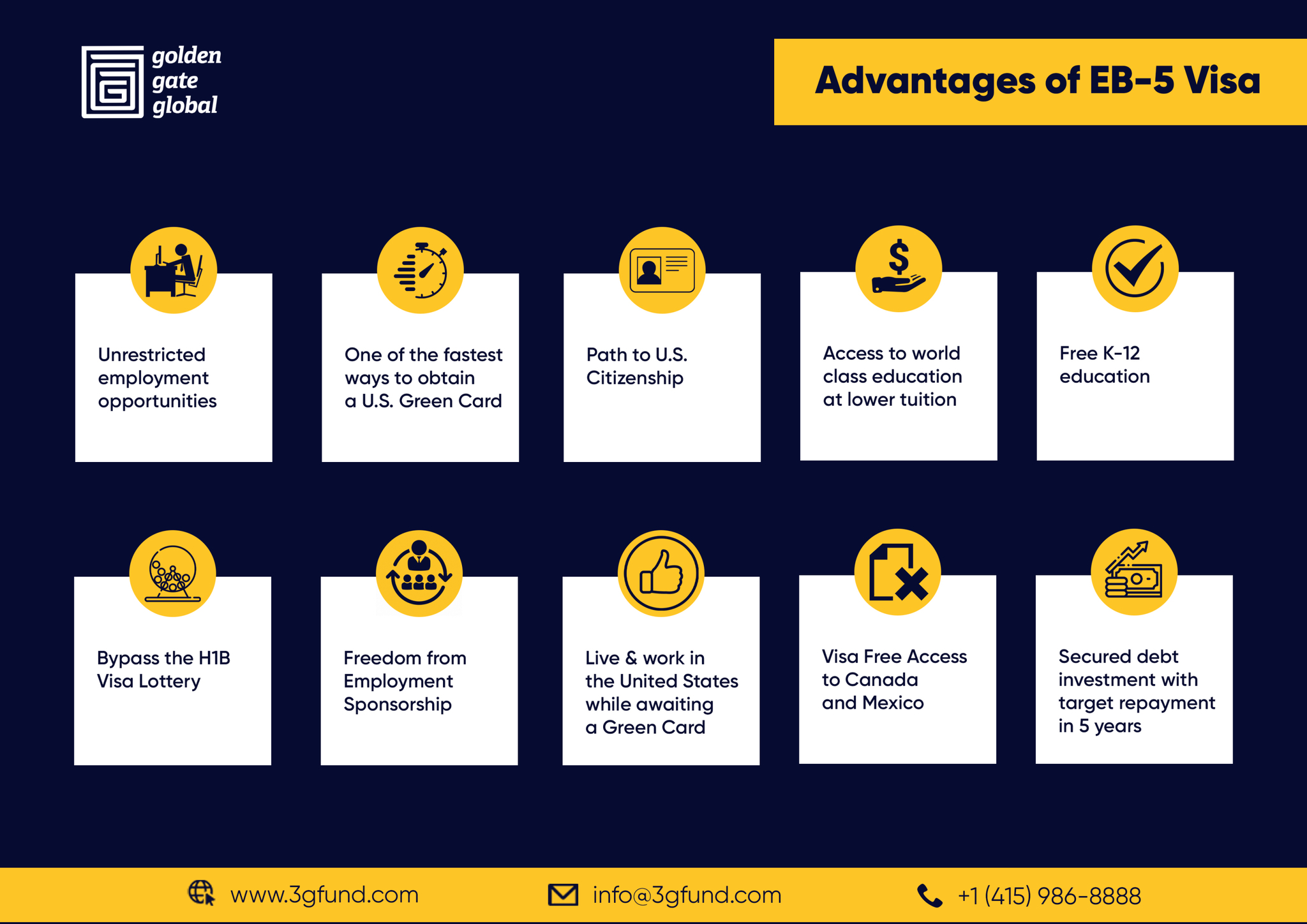

Citizenship, through investment. Currently, as of March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Work Locations and Backwoods) and $1,050,000 elsewhere (non-TEA areas). Congress has actually authorized these quantities for the following 5 years beginning March 15, 2022.

To receive the EB-5 Visa, Financiers need to develop 10 full-time U.S. jobs within two years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Demand guarantees that investments add straight to the united state task market. This uses whether the work are created directly by the commercial business or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

Eb5 Investment Immigration Fundamentals Explained

These work are identified with models that utilize inputs such as development expenses (e.g., building and tools expenditures) or yearly profits created by ongoing procedures. On the other hand, under the standalone, or straight, EB-5 Program, just straight, permanent W-2 employee placements within the business may be counted. A key risk of depending entirely on direct staff members is that personnel decreases as a result of market problems could lead to insufficient full time placements, possibly causing USCIS rejection of the investor's application if the work development requirement is not satisfied.

The financial model then projects the variety of straight jobs the new business is most likely to create based on its anticipated profits. Indirect jobs calculated via economic designs describes work generated in sectors that provide the products or services to business straight included in the job. These jobs are created as a result of the boosted demand for products, products, or services that support the organization's procedures.

Some Known Factual Statements About Eb5 Investment Immigration

An employment-based fifth choice group (EB-5) investment visa supplies a method of becoming an irreversible U.S. citizen for international nationals wanting to spend capital in the United States. In order to get this environment-friendly card, a foreign financier should spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Area") and create or protect at the very least 10 permanent jobs for USA employees (excluding the capitalist and their instant family).

This step has actually been a remarkable success. Today, 95% of all EB-5 resources is raised and spent by Regional Centers. Considering that the 2008 economic crisis, access to resources has actually been constricted and local spending plans remain to deal with considerable shortages. In numerous regions, EB-5 financial investments have actually filled the funding void, giving a new, important source of capital for regional financial advancement tasks that rejuvenate areas, produce and sustain work, framework, and services.

A Biased View of Eb5 Investment Immigration

Even more than 25 countries, consisting of Australia and the United Kingdom, usage comparable programs to bring in foreign investments. The American program is a lot more strict than many others, needing considerable danger for capitalists in terms of both their monetary investment and migration status.

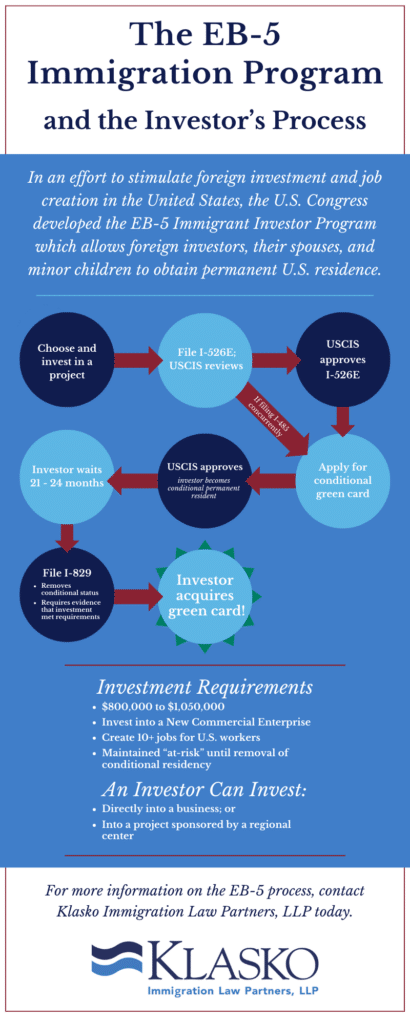

Households and individuals that seek to transfer to the United States on a long-term basis can get the EB-5 Immigrant Financier Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) laid out numerous demands to get long-term residency via the special info EB-5 visa program. The needs can be summarized as: The capitalist should satisfy capital expense quantity needs; it is commonly called for to make either a $800,000 or $1,050,000 capital expense amount into a UNITED STATE

Speak with a Boston immigration lawyer regarding your demands. Here are the general steps to obtaining an EB-5 financier environment-friendly card: The primary step is to discover a qualifying financial investment chance. This can be a new company, a local center project, or an existing company that will be increased or reorganized.

Once the possibility has actually been determined, the financier has to make the financial investment and submit an I-526 petition to the united state Citizenship and Migration Provider (USCIS). This request must include proof of the financial investment, such as financial institution declarations, acquisition arrangements, and business strategies. The USCIS will certainly examine the I-526 application and either approve it or demand extra evidence.

All About Eb5 Investment Immigration

The financier should get conditional residency by sending an I-485 request. This petition needs to be submitted within six months of the I-526 authorization and must consist of evidence that the financial investment was made and that it has produced at the very least 10 permanent tasks for united state workers. The USCIS will certainly evaluate the I-485 petition and either accept it or request added evidence.